Understanding Gold’s Market Cycles

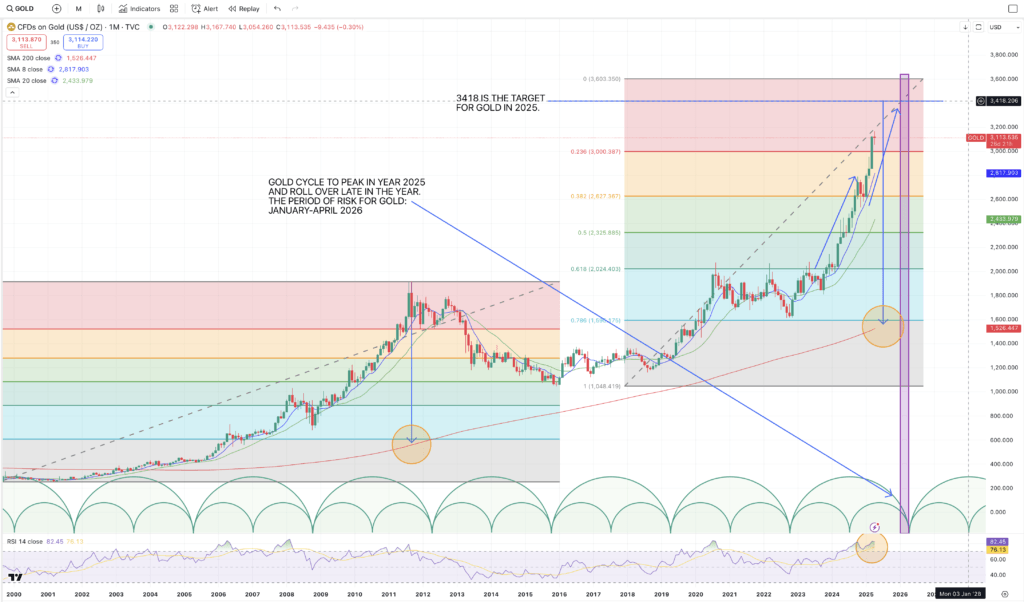

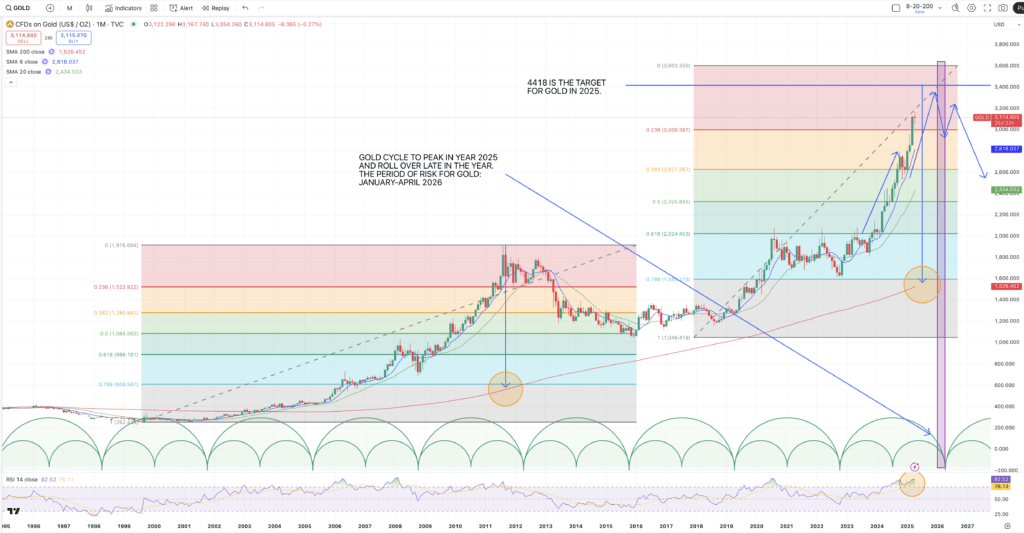

Gold operates in long-term market cycles, often influenced by macroeconomic conditions, inflation trends, and investor sentiment. These cycles follow periods of steady accumulation, parabolic growth, and subsequent corrections. By analyzing historical price movements and Fibonacci projections, we can identify potential price targets and turning points in the current gold bull market.

The Concept of Measured Moves in Price Projections

A measured move is a fundamental concept in technical analysis that helps traders and investors forecast price targets based on prior price movements. It operates on the principle that after forming an initial leg of a move, the market tends to replicate a similar move in the direction of the prevailing trend. By identifying the first leg’s price range, we can project an equivalent distance for the next leg, providing a potential target.

In gold’s current projections, we employ the measured move concept alongside Fibonacci levels and simple moving averages to refine our expectations. Additionally, we analyze the space between the current price and key moving averages—especially the 200 MA—as a critical factor in determining market exhaustion and potential reversal points.

First Major Leg: February 12, 2024 – October 28, 2024

In the first major leg of this cycle, gold surged from approximately $1,984 to $2,790, representing an increase of $806. This price movement provides a strong foundation for projecting future levels in the current bull run.

Second Major Leg & Price Projection: December 30, 2024 Onward

By applying the same $806 price increase to the next phase, which starts at $2,596, we arrive at a projected price level of $3,402. However, considering the market’s tendency to overshoot major resistance levels at round numbers (in this case, $3,400)—both upwards and downwards—we extend our projection to $3,418. This level aligns with the measured move concept and psychological round numbers, which often act as significant resistance zones.

While Fibonacci levels indicate a potential upside as high as $3,600, we assign a low probability to such an extreme move. Instead, we anticipate profit-taking and increased volatility near $3,400, prompting an exit strategy around $3,190-3,380.

Key Observation: 200 MA and Its Role in Gold’s Climactic Moves

A crucial factor to monitor in gold’s current cycle is the separation between its price and the 200 Moving Average (MA). Historically, the larger the gap between the two, the higher the likelihood of an imminent price climax. An interesting observation is that during the first major bull cycle from 2001 to 2012, gold peaked as the 200 MA approached the first Fibonacci level. In our current cycle, we are witnessing a similar setup, suggesting that gold may be nearing a major inflection point. If history repeats itself, this could reinforce our $3,418 projection as the potential climax of this rally.

Final Thoughts

Gold’s ongoing bull cycle presents significant opportunities for traders and investors who understand market cycles, Fibonacci projections, and historical price patterns. While $3,418 remains our primary target, prudent risk management is essential, as market conditions can shift unexpectedly. Keeping an eye on key resistance zones such as $3,000 zone, the 20 MA, and macroeconomic factors will be crucial in navigating this cycle successfully.

Understanding market cycles is essential for successful trading, whether you’re analyzing Bitcoin, gold, or broader financial markets. Just like Bitcoin experiences its unique boom-and-bust cycles, gold too follows long-term cycles that heavily influence price movements. By diving into these historical patterns, traders can uncover high-probability setups and foresee potential turning points.

If you’re interested in how market dynamics play out across different assets, check out our deep dives into Bitcoin’s full cycle analysis and the Trump trade’s impact on capital flows for more insights into navigating volatile markets.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Markets are volatile and unpredictable. Conduct your own research and consult with a financial professional before making any investment decisions.