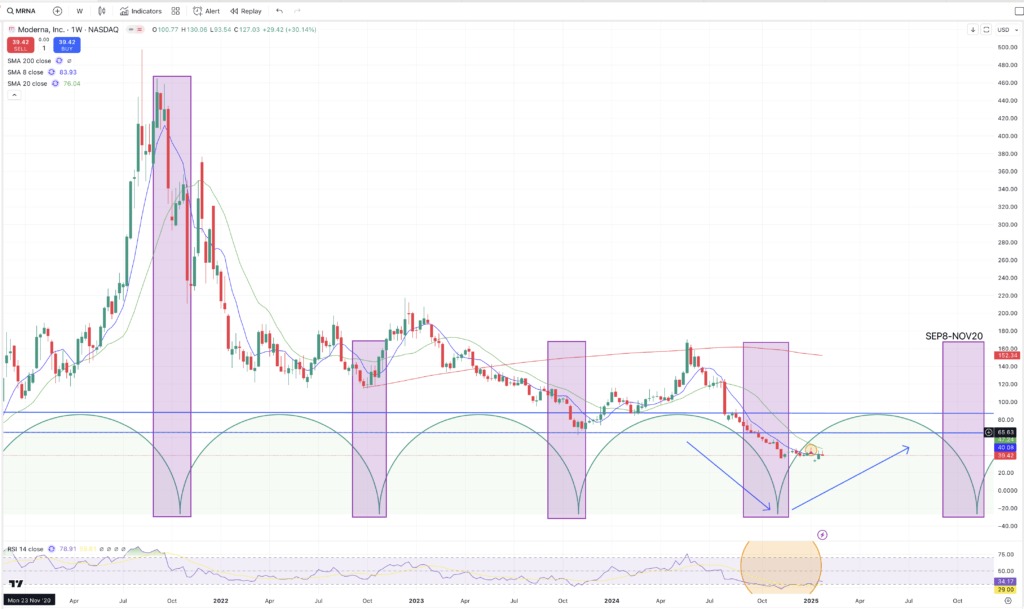

In my previous post, “Beat SPX in 2025 by 100%: Long-Term MRNA Trade”, I highlighted how Moderna (MRNA) was showing early signs of a potential trend reversal after an 81% decline from its May 2024 peak. While short-term volatility remains, the stock is setting up for a major move, with potential 26% gains in just three months and 100% upside within a year.

But what about the bigger picture?

Looking beyond 2025, Moderna’s long-term growth prospects could turn it into a 300% winner over the next five years. With its expanding mRNA pipeline, growing adoption of personalized medicine, and potential breakthroughs in cancer treatments and rare diseases, the company is positioning itself as a biotech powerhouse. If MRNA reclaims key technical levels and capitalizes on these advancements, a move back to $120–$150 by 2030 is a very real possibility.

MRNA Stock Outlook: Is the Bottom In?

Right now, Moderna (MRNA) remains in a clear downtrend, with price action still struggling and consolidating. To confirm a trend reversal, the stock must close above $48. Until then, the current $32–$40 range is still at risk of potential breakdown to $20 before a meaningful recovery.

However, several key factors indicate that a major bottom may be forming:

✅ Oversold Conditions – Since peaking at $170.47 in May 2024, MRNA has plunged 81% to its January 13, 2025 low of $31.94. Such a steep drop suggests a bounce is due.

✅ RSI Recovery – The Relative Strength Index (RSI) is emerging from the oversold zone and trending higher, signaling a potential shift in momentum and increasing the likelihood of a short-term rebound.

✅ Shorting Challenges – The stock is becoming increasingly difficult to short, which could increase the likelihood of a sharp upside move.

✅ Accumulation Zone – For long-term investors, this price range presents a strong accumulation opportunity. Even if MRNA drops to $20, it would likely be a screaming buy that doesn’t remain at that level for long.

🚀 Potential Upside in 2025: Key Price Targets

A new upward time cycle is expected to begin by late January 2025, with momentum potentially lasting through early September 2025.

📌 First Target: $65 – A potential 65% gain before entering a risk window (September–November 2025).

📌 Second Target: $84+ – If momentum continues, 113% upside by year-end is possible.

🔹 Key Takeaway: While short-term risks remain, including a potential final dip toward $20, MRNA’s long-term potential is setting up for a major recovery play.

📈 Can MRNA Surge 300% in 5 Years?

Moderna (MRNA) has the potential to skyrocket 300% over the next five years, fueled by:

- MRNA technology breakthroughs in cancer, rare diseases, and personalized medicine

- Expansion into billion-dollar biotech markets beyond COVID-19 vaccines

- Increasing global regulatory approvals and commercial rollouts

If Moderna successfully executes on these catalysts, a return to $120–$150 levels by 2030 is a very real possibility—marking a 300%+ gain from today’s prices.

Final Thoughts: Is It Time to Buy MRNA?

With oversold conditions, upcoming catalysts, and a potential new uptrend, Moderna presents a high-reward opportunity for traders and long-term investors. The short-term trend remains weak, but any final dip could offer a prime accumulation zone before a strong upside move.

📢 Are you positioning for the next big move in MRNA? Let’s discuss! 🚀

IMPORTANT DISCLAIMER: This information is for educational purposes only and does not constitute financial advice. Investing involves risks, including potential loss of principal. Past performance does not guarantee future results. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. Market conditions change frequently, and individual circumstances vary. This content should not be construed as a recommendation to buy, sell, or hold any specific security.