🧊🚢 Captain Trump, the Tariff Iceberg & the Sinking SPX: Are We Already Doomed or Just Ordering Drinks?

As Captain Trump steers toward a tariff-fueled iceberg, hedge funds scramble below deck. Will the market float or take on water? The countdown begins…

🎩🚢 The Titanic Moment: A Trump Metaphor for the Markets

In our metaphorical reenactment of the financial world, Donald Trump is the captain of the economic Titanic, confidently steering the ship through an icy ocean. The iceberg? Tariffs and policies that triggered a chain reaction of economic uncertainty, credit tightening, and hidden financial fragility.

Right now, we’re not at the bottom of the ocean — we’re in the surreal, eerie calm just minutes after impact. Drinks are still being served, and the band’s playing its last tune. But below deck, hedge funds and banks are scrambling, assessing damage, and trying to figure out how not to go under.

🧠💥 The Basis Trade: What Is It and Why Should You Care?

In very simple terms:

Hedge funds borrow tons of money to buy actual Treasury bonds, while simultaneously selling futures contracts on those same bonds.

This strategy is called the basis trade — they’re betting the small price gap (the “basis”) between bonds and futures will close, letting them pocket the difference.

Sounds smart? It is… until it isn’t.

When volatility spikes or bond prices move too quickly, that tiny, predictable profit vanishes. And because these hedge funds use extreme leverage — borrowing 30 to 50 times their own capital — even a small price move becomes a tsunami of losses.

But here’s the real problem: it’s not just the hedge funds who bleed. The banks that lend them the money take the bigger hit. Those leveraged trades are on bank balance sheets, which means the pain spills into the financial system.

And when the banks start wobbling? Guess who shows up again — Uncle Sam with another round of bailouts. Because when the iceberg hits, it’s not just the passengers in first class that go down.

🏦⚠️ How It Affects Banks and the Financial System

Banks often fund these trades or provide the leverage. If hedge funds can’t unwind fast enough (which they can’t when the market’s moving fast), it creates a liquidity crisis.

- If they all sell at once → Prices collapse.

- If prices collapse → Banks take hits.

- If banks take hits → Governments may have to step in (yes, another potential bailout scenario).

This is why speed matters. The faster the bond market moves, the less time hedge funds have to adjust. They’re like passengers trapped below deck—too leveraged to get out, too slow to swim.

📉📊 Is the Market Going to Zero? Not Quite… But Look at This SPX Chart

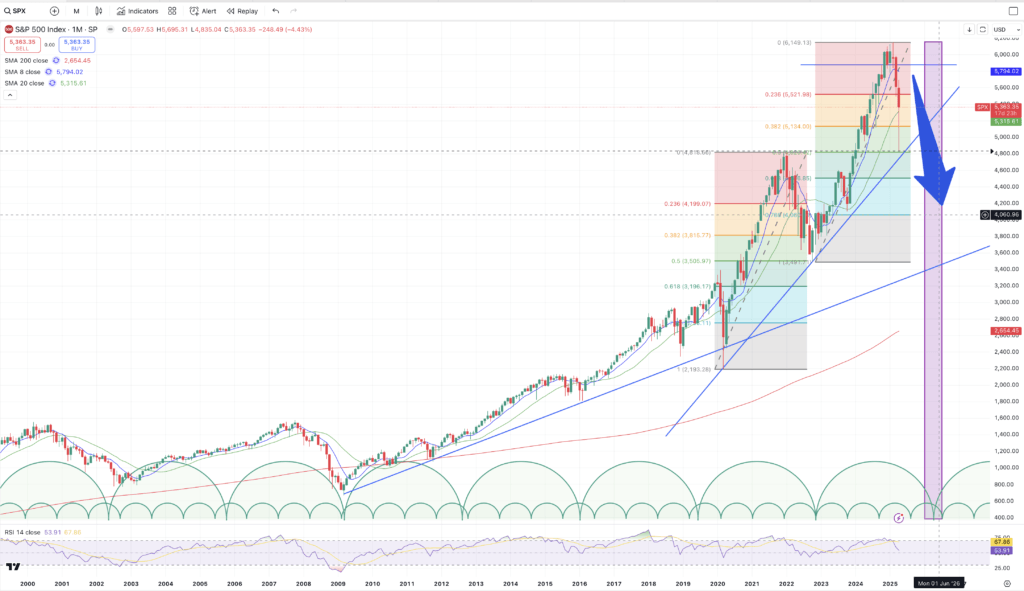

Take a look at the S&P 500 Index (SPX) chart above.

If this were a single stock, you’d probably say:

“Yup, that’s going back to the 0.786 Fibonacci retracement, maybe even a full unwind of the parabolic move.”

And you’d probably be right.

So… what about SPX?

From a monthly chart perspective, SPX shows clear cyclical behavior and signs of topping. We’re currently just off all-time highs, but the next cycle low aligns with Summer 2026 — right in that danger zone marked on the chart.

- Fib levels to watch:

- 0.382 at ~5100

- 0.50 at ~4800

- 0.618 at ~4500

- 0.786 at ~4060 👀

If a major dislocation unfolds — whether from the basis trade unraveling or a broader credit crisis triggered by bond market volatility — the SPX could realistically drop into the 4500–3500 range.

And here’s where it gets even more interesting: on the chart, the long-term support line dating back to 2008 aligns closely with the 3500 level, marking a more realistic mean reversion point after years of frothy market behavior.

Even more chilling? That 3500 zone isn’t just technical support — it also represents a 50% Fibonacci retracement of the entire bull run from 2009 to the 2025 peak. That’s the market’s way of saying: “Let’s reset and find some gravity again.”

In other words, if this ship’s going down, the charts suggest it knows exactly where the ocean floor is.

🧊📈 But Wait — Why Is the Market Still Going Up?

Remember: even on the Titanic, the back of the ship lifted before it sank.

Markets don’t crash in a straight line.

They lure traders and investors alike with “this is just a dip” bounces, earnings hype, or sudden bursts of Fed-fueled optimism. But make no mistake — these are often the final dances before the plunge.

And here’s the kicker: the chaos looks different depending on your time frame.

Short-term traders will experience violent swings, gut-wrenching drawdowns, and “rip-your-face-off” rallies, where the market can spike more than 10% in a single day — just like we saw recently.

Inexperienced traders and retail investors often get sucked in during these rallies, thinking the worst is over. But what feels like opportunity is sometimes just the market sharpening its teeth.

These sudden surges make it even harder for hedge funds to unwind. They hold on, hoping for another pop. But as history shows us, late-stage melt-ups often come just before violent breakdowns. The illusion of strength is the bait — and the real damage happens after the crowd’s already back on board.

🧠 Final Thought: Don’t Ignore the Band While the Hull Is Taking on Water

We are living in the minutes after the crash, not the calm before it. The drinks are flowing, CNBC is upbeat, and tech earnings are “better than feared.” But smart money is watching the plumbing of the financial system — and what they see isn’t good.

Whether it’s the basis trade, policy risks, or leveraged speculation, the Titanic of 2025 may not survive without serious intervention.

🚨 A Word of Caution to Inexperienced Traders and Investors

If you’re new to trading, this is not the time to play hero.

These market conditions are not a playground — they’re a battlefield. Wild price swings, sudden reversals, and manipulated rallies can wipe out accounts in hours, not weeks.

Sit this one out. Let the dust settle. Observe, learn, and protect your capital.

For investors:

This is the moment to consult a professional.

Passive, “set it and forget it” investing won’t cut it in this environment. Your portfolio will likely need active risk management and tactical adjustments for the foreseeable future.

The era of buying anything and watching it go up is on pause. Don’t assume what worked from 2009 to 2025 will work now — this is a different game.

📌 Related Reads:

If you’re enjoying this deep dive into market dynamics and Trump-era policy fallout, don’t miss these other sharp takes:

👉 The Trump Trade: Understanding Market Cycles and Capitalizing on the Fall

👉 The Gold Express: Last Stop Before the Boom Goes Bust

These blogs pull back the curtain on what’s really driving market moves — and how to position yourself before the herd catches on.

Let me know if you want a version tailored for X or email too.

📉 Disclaimer

This content is for informational and entertainment purposes only and does not constitute financial advice. Always do your own research or consult a licensed financial advisor before making investment decisions. Trading and investing involve substantial risk, and you can lose money.